American Express Gold card review

[ad_1]

Story highlights

Thanks to up to $340 in annual credits next year, the American Express® Gold Card can actually be profitable in 2021

The card is ideal for people who spend lots of money at restaurants and U.S. supermarkets

(CNN) —

CNN Underscored reviews financial products such as credit cards and bank accounts based on their overall value. We may receive a commission through The Points Guy affiliate network if you apply and are approved for a card, but our reporting is always independent and objective.

Our quick take: The American Express® Gold Card is a foodie’s dream, allowing you to rack up plenty of Membership Rewards points with its bonus categories on dining worldwide and at US supermarkets. And right now, thanks to credits that were recently added to the card, you can actually make money in 2021 just by having it.

Pros:

- With up to $340 in included credits in 2021, card members can get more money next year from the Amex Gold than it costs.

- Earn an industry-leading 4 points for every dollar you spend on dining worldwide.

- Earn 4 points per dollar at US supermarkets up to $25,000 per year (1 point per dollar thereafter).

- Earn 3 points per dollar on flights booked directly with airlines.

Cons:

- Credits require planning and strategy to maximize.

- Other cards may be better for everyday purchases.

- $250 annual fee.

Current welcome bonus: Earn 60,000 bonus points after you spend $4,000 on eligible purchases within the first six months after opening the account.

Best for: Points-minded travelers who spend significant money each month on dining, groceries and travel.

The American Express Gold is a standout card, largely due to its clear efforts to be top-of-wallet in a few categories that are significant to many US households. Take a look at your budget — do you spend a fair amount of your cash on food right now? Chances are, the answer is yes.

Amex designed the Gold Card to cater to those who spend nontrivial amounts at restaurants and on groceries, offering 4 points for every dollar you spend at eateries worldwide and at supermarkets in the United States. You’ll also net 3 points per dollar on flights booked directly with airlines, which isn’t too shabby.

The current 60,000-point welcome bonus — available after you spend $4,000 on purchases in your first six months of card membership — is the highest bonus offer we’ve ever seen available on this card. And those Membership Rewards points are worth at least $600 when you redeem them via Amex Travel for airfare, and potentially a lot more than that with Amex’s transfer partners.

But here’s the best part: When you combine the bonus with up to $120 in annual dining credits on the card, up to $120 in Uber Cash starting early next year and up to $100 in annual airline fee credits in both 2020 and 2021, American Express is literally compensating you to hold this card, at least for the first year you have it.

Click here for the bonus offer on the American Express Gold card.

The biggest long-term advantage of the American Express Gold is its superior earning rate at US supermarkets and restaurants worldwide. With no foreign transaction fees, this should be your go-to card for dining everywhere you go. In fact, those bonus categories are so strong that it may be worth holding this card even if you only ever use it for dining and groceries.

Given that this is very much a food lover’s card, it comes as no surprise to see up to $120 in annual statement credits are available for select dining spots as well. You can earn up to $10 in statement credits each month (so, $120 annually) when you pay with the Gold Card at Grubhub, Seamless, The Cheesecake Factory, Ruth’s Chris Steak House, Boxed and participating Shake Shack locations.

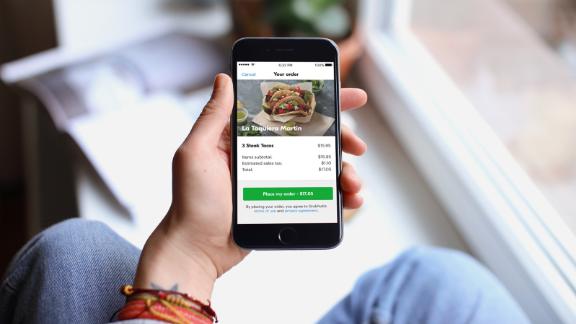

Get up to $10 in credits each month for purchases at Grubhub and other select dining establishments.

PHOTO:

Grubhub

But that’s only the half of it. American Express recently announced that the Amex Gold also now comes with both a complimentary Uber Eats Pass membership for up to 12 months and, starting early next year, up to $120 in Uber Cash annually, doled out in $10 portions each month. Uber Cash can be used either for Uber rides, or on food delivery orders made with Uber Eats.

And people who expect to get back into the air next year will not only earn 3 points per dollar on flights booked directly with an airline, but can also select one airline in both 2020 and again in 2021 to receive up to $100 in statement credits when incidental fees are charged by the airline to your American Express Gold account. This includes things like checked bags and in-flight food, though it doesn’t apply to seat upgrades or gift card purchases.

Add it all together, and you’re getting up to $340 in credits. Since the Amex Gold has an annual fee of $250, if you can use all the credits, you’re effectively getting back $90 more for the card in 2021 than you’re paying for it. Yes, that means this card can actually make you money next year.

And then there are the points. How much potential value can you get with the Membership Rewards points you earn with the Amex Gold? While you can exchange points for cash in order to pay down the balance due on your statement, each point nets you just 0.6 cents when you redeem them that way.

You can also shop at Amazon with Amex points at a rate of 0.7 cents apiece, or redeem for an array of gift cards or for airfare at Amex Travel at around 1 cent per point. Plus, Amazon sometimes offers additional discounts on purchases when using Amex points to pay for even a part of your order.

Related: Get up to $50 off at Amazon with targeted American Express cards.

But while the above options are easy — and yes, it’s important to have easy options — savvy travelers will want to utilize Amex’s 21 transfer partners for remarkable redemptions. Amex has partnerships with myriad hotels and airlines, enabling Membership Rewards points to be used for travel that would be prohibitively expensive if paid for in cash.

Amex also includes a baggage insurance plan on the Gold Card, covering eligible lost, damaged or stolen baggage when you purchase the entire fare for a plane, train, ship or bus ticket with the card. In addition, you’ll get secondary car rental loss and damage insurance for most vehicle types and in most countries.

And the Amex Gold now also comes with trip delay insurance, meaning if your trip is delayed more than 12 hours due to a covered reason, you can get up to $300 in unexpected expenses reimbursed.

A couple of overlooked-but-useful perks: American Express cardholders are often eligible for early access to tickets through Ticketmaster. If you’re in a large city and love concerts, getting a head start on ticket sales can be the difference between an enviable seat and a chair in the nosebleeds.

Also, Amex Offers have been quite stout of late. This is a rotating selection of discounts, covering everything from clothing to tax preparation software to travel. Those who make a habit of watching new ones pop up can save hundreds per year on purchases they were planning to make anyway.

Get more in annual credits than you’ll pay for the American Express Gold card.

The Amex Gold is a good choice for dining and at supermarkets, but not as an everyday card.

PHOTO:

iStock

The American Express Gold is a specialized card. Beyond dining, supermarkets and airfare, you’ll earn only 1 point for every dollar you spend on everything else. This means the card works best when paired with a card like our benchmark credit card, the Citi® Double Cash Card, for purchases that don’t fall into the Gold Card’s bonus categories.

Related: Read CNN Underscored’s review of the Citi Double Cash Card.

While the included credits are worth more than the annual fee next year — and almost as much as the annual fee each year starting in 2022 and beyond — they take a bit of strategy to use. The dining credit, for example, is capped at $10 per month, so you can’t just use it in one fell swoop. Plus, the list of eligible restaurants is small. If you live in an urban area where Grubhub and Seamless are available, utilizing this credit becomes easier. But if you don’t, maximizing the dining credit can be a challenge.

The airline fee credit can also be tough to spend, particularly for those who already have airline elite status, and in turn, don’t have to pay for checked bags when flying their airline of choice. You’re also restricted to just one airline each year with the Amex Gold, unlike the broader travel credit of the Chase Sapphire Reserve, which applies not only to most airlines but also to a broad array of travel purchases.

Also, while this won’t impact many families, it’s worth noting that the 4x return at US supermarkets is capped at $25,000 per calendar year with the Gold Card. If you spend more than that on groceries in a year, you’ll earn just 1 point per dollar after that.

Finally, it’s worth mentioning that Membership Rewards points take some studying and effort to really maximize. Managing transfer partners and dealing with dynamic award charts may feel like too much work for many, and you can’t easily transfer Amex points to friends who may view this as a hobby. If you’re looking for travel rewards that are easier to redeem, you’ll likely want to pick a card like the Capital One® Venture® Rewards Credit Card or Chase Sapphire Preferred as an alternative.

CNN Underscored has chosen the Citi Double Cash card as our “benchmark” credit card. That doesn’t mean it’s the best credit card on the market — rather, it means we use it as a basic standard to compare other credit cards and see where they score better, and where they’re worse.

Here’s how the Amex Gold scores against our benchmark. The features of each card in the below chart are colored in green, red or white. Green indicates a card feature that is better than our benchmark. Red indicates the feature is worse than our benchmark, and white indicates the feature is either equivalent or cannot be directly compared to our benchmark.

When reviewing other credit cards, we use this format and these criteria to compare them with our benchmark. You can read our credit card methodology for more details on what we take into account when it comes to perks, protections and redemption value.

Start earning bonus points at restaurants and U.S. supermarkets with the American Express Gold card.

For foodies, there’s one other notable credit card to consider: the Capital One® Savor® Cash Rewards Credit Card. This cash back credit card has a $95 annual fee and offers unlimited 4% cash back on dining and entertainment, 2% cash back at grocery stores and 1% cash back on all other purchases. If you prefer cash back over travel points or miles, the Savor card may be the way to go — particularly if you can’t easily leverage the annual credits on the Amex Gold.

However, while cash back is infinitely more flexible than travel rewards — you can spend cash anywhere — you also can’t increase the value of cash back the way you potentially can with points or miles. Membership Rewards points can be used with Amex’s transfer partners to score premium trips for much less than you’d normally pay in cash, effectively increasing the value of your points when you redeem them.

Also, although it may not be immediately apparent, folks who are fond of the bonus categories on the Amex Gold should also look at the Hilton Honors American Express Surpass® Card. With a $95 annual fee, this card earns 6 Hilton Honors points for every dollar you spend at US restaurants, US supermarkets and US gas stations.

But keep in mind that points aren’t all created equal. According to the point valuations of CNN Underscored’s partner The Points Guy, American Express points are worth 2 cents apiece, while Hilton points are only worth 0.6 cents each. That makes 4 points on the Amex Gold worth 8 cents, while 6 Hilton points are worth just 3.6 cents.

The American Express Gold is a must-have for those who know they’ll spend heavily at restaurants and US supermarkets, and who also have the patience to maximize their Membership Rewards points through Amex’s transfer partners. While cards like the Capital One Savor have a lower annual fee and no hoops to jump through to redeem your cash back, the 60,000-point bonus on the Amex Gold and credits that can be worth more than the annual fee next year make it the winner right now.

So if you’re looking to redeem credit card rewards for exotic travel once the pandemic is over, and you spend a lot of your time eating in or dining out, the Amex Gold could be a great fit for you. And if you decide it’s a card that should be in your wallet, make sure to grab it now and get it with the highest welcome bonus offer we’ve ever seen for it, and credits that make the card pay for itself in 2021.

Learn more about the American Express Gold Card.

Find out which cards CNN Underscored chose as our best credit cards of 2020.