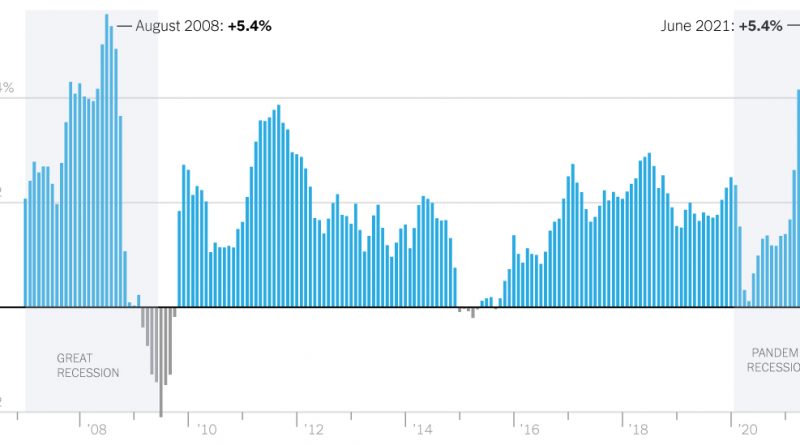

Inflation Rose in June With C.P.I. Up 5.4 Percent

[ad_1]

The Fed targets 2 percent annual price gains on average over time, a goal it defines using a different index. Still, the C.P.I. is closely watched because it comes out more rapidly than the Fed’s preferred gauge and it feeds into the favored number, which has also accelerated.

Republicans have pointed to rapid price gains as a sign of the Biden administration’s economic mismanagement, and an argument against the kind of additional spending that President Biden has called for as part of his $4 trillion economic agenda, including investments to fight climate change, bolster education and improve child care.

“Bidenflation is growing faster than paychecks, wiping out workers’ wage gains, and leaving American families behind,” Republicans on the House Ways and Means Committee said in a news release following the data report.

The talking point has proved potent because the recent strength in inflation has outstripped the pickup that many officials had expected. In Mr. Biden’s official budget request, released this spring, officials forecast an inflation rate that stayed near historical averages for 2021 and never rose past 2.3 percent a year over the course of a decade. Administration officials have now begun to acknowledge that higher inflation could stay with the economy for a year or two.

The possibility that inflation will not fade as quickly or as much as expected is becoming a defining economic risk of the era. Signs that strong demand could bolster prices, at least for a time, abound. A New York Fed survey out Monday showed that consumers expect to keep spending robustly in the year ahead.

Some members of the business community see price pressures lasting.

Hugh Johnston, the chief financial officer of PepsiCo, told analysts on Tuesday that the company was anticipating more inflationary pressures via higher costs for raw materials, labor and freight. “Are we going to be pricing to deal with it? We certainly are,” he said.

Jamie Dimon, JPMorgan Chase’s chief executive, told analysts on a conference call on Monday that “it’ll be a little bit worse than the Fed thinks. I don’t think it’s all going to be temporary. But that doesn’t matter if we have very strong growth.”

[ad_2]

Source link