Manhattan’s Office Buildings Are Empty. But for How Long?

[ad_1]

Even as the coronavirus pandemic appears to recede in New York, corporations have been reluctant to call their workers back to their skyscrapers and are showing even more reticence about committing to the city long term.

Fewer than 10 percent of New York’s office workers had returned as of last month and just a quarter of major employers expect to bring their people back by the end of the year, according to a new survey. Only 54 percent of these companies say they will return by July 2021.

Demand for office space has slumped. Lease signings in the first eight months of the year were about half of what they were a year earlier. That is putting the office market on track for a 20-year low for the full year. When companies do sign, many are opting for short-term contracts that most landlords would have rejected in February.

At stake is New York’s financial health and its status as the world’s corporate headquarters. There is more square feet of work space in the city than in London and San Francisco combined, according to Cushman & Wakefield, a real estate brokerage firm. Office work makes up the cornerstone of New York’s economy and property taxes from office buildings account for nearly 10 percent of the city’s total annual tax revenue.

What is most unnerving is that a recovery could unfold much more slowly than it did after the Sept. 11 attacks and the financial crisis of 2008. That’s largely because the pandemic has prompted companies to fundamentally rethink their real estate needs.

Robert Ivanhoe, a real estate lawyer at Greenberg Traurig, said he had about 20 clients that had postponed searches for new offices. “They are putting a lot of thought into coming up with a new operating model — how much of my work force is going to work from home and for how much time?” he said. “It has never been turned upside down like this before.”

Real estate data confirms that. The number of office leases signed from January through August totaled 13.7 million square feet, less than half as much as the first eight months of last year, according to Colliers International, a real estate brokerage firm. By contrast, leasing hit an 18-year high at the end of last year with nearly 43 million square feet of new leases and renewals.

“When it comes to making decisions about office leases, the words are postpone, adjourn and delay,” said Ruth Colp-Haber, the chief executive of Wharton Property Advisors, a real estate brokerage firm.

Executives at the meal delivery company Freshly were ready to sign a lease for 50,000 square feet of office space at 2 Park Avenue, a stately, 29-story Art Deco tower in Midtown, in March.

But the coronavirus abruptly shut New York down for several months, and the company “hit pause” on its expansion, said Michael Wystrach, Freshly’s founder and chief executive. The company is still considering new office space, but he isn’t sure when it would sign a lease. “We are long-term believers in New York City.”

Elected officials, real estate tycoons and even Jerry Seinfeld, the comedian, have issued paeans to New York’s resilience, arguing that city has a history of bouncing back. The city will soon be brimming with people, by their telling.

But pessimists — including some New York hedge fund managers — see dark days ahead. They contend that companies will tell most employees to stay away until a vaccine is widely distributed and perhaps for much longer.

Which of those two visions is closer to being right will help determine how quickly New York regains its energy, economic health and tax revenue.

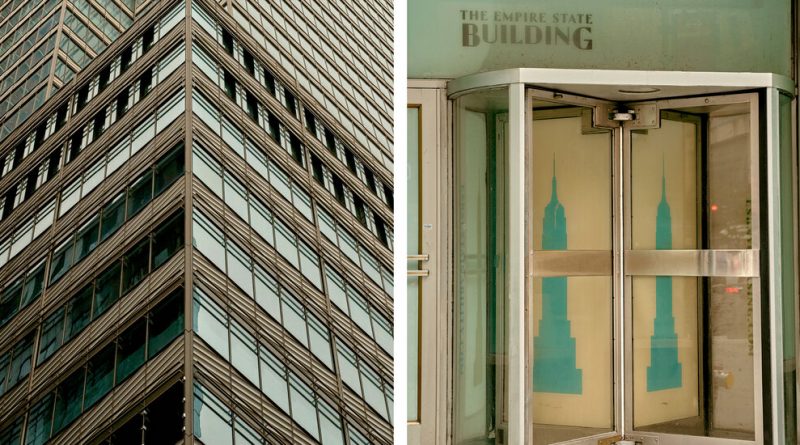

Investors are not expecting a quick recovery. Shares of companies with lots of New York office space like Empire State Realty Trust, which owns the Empire State Building, and SL Green Realty, which owns the immense new One Vanderbilt tower next to Grand Central Terminal, have plunged this year.

“I think the New York office market is going to be generally challenged for the next three to five years,” said Jonathan Litt, the founder of the hedge fund Land & Buildings. His fund published a report in May on why it thinks the shares of Empire State Realty Trust are overvalued.

A big part of the problem is that many companies are holding off on new leases.

In recent years, the biggest renters of office space have been co-working companies like WeWork, New York’s largest private tenant. Such businesses signed nearly 8 percent of new leases in Manhattan last year and 12 percent in 2018, according to Cushman & Wakefield. But co-working companies are in distress and some may not survive.

Other potential renters of offices are unsure what to do or are waiting for landlords to reduce rents, factoring in incentives like rent-free months and cash for office improvements. “What’s the point of signing a lease with a 15 percent decrease in rent if you think it’s going to go lower?” said Michael Colacino, the president of the brokerage firm SquareFoot.

Some companies with leases that are ending this year or next appear to be kicking the can down the road, signing short-term extensions rather than committing to typical deals that last several years. In recent weeks, NBC Universal extended a lease for a secondary office at 1221 Avenue of Americas and the Stroock & Stroock & Lavan law firm did the same for its office downtown. But they both did so for just a year, according to Colliers. A spokeswoman for NBC Universal declined to comment and Stroock & Stroock did not return a call and multiple emails.

In normal times, owners of large office buildings would typically not entertain a one- or two-year lease extension for a large tenant, said Franklin Wallach, senior managing director of the New York Research Group at Colliers. “They see that new leasing activity has dropped off while the amount of sublet space coming into the market is on the rise, so the average landlord wants to keep the tenant in the building.”

One of the biggest concerns is that companies could soon start trying to sublease hundreds of thousands of square feet of space that they are not planning to use anytime soon. For companies seeking offices, sublets often provide a shorter lease at a steep discount to market prices.

Starr Insurance Companies, which is led by Maurice R. Greenberg, is seeking to sublet 190,000 square feet that it leases at 399 Park Avenue, according to Colliers. And First Republic Bank, which signed a 211,521-square-foot lease last April for 410 Tenth Avenue, put 151,000 square feet up for sublet, according to a report from the real estate broker Savills. Spokesmen for Starr and First Republic declined to comment.

Sublet space made up about a quarter of the total office space available in New York at the end of the second quarter, according to Savills, and many real estate brokers said they expected that to increase in the coming months.

In January, Ms. Colp-Haber was showing offices to a construction company that she said was in the market for a five-year lease in Manhattan. Last month, the company signed a sublet for one year at a 40 percent discount to the original lease, she said.

Still, property owners claim not to be overly worried because most tenants are paying their rent. They point out that office leases last for years and are very difficult to end early. And large financial firms, among the biggest tenants in New York, aren’t stressed as they were in the last recession.

The most optimistic sign that New York’s office market will bounce back quickly is that big technology companies, which are gaining ground, are scarfing up square feet. Facebook in early August leased all of the office space — 730,000 square feet — in the Farley Post Office next to Penn Station. Amazon acquired the former Lord & Taylor building on Fifth Avenue in March from WeWork.

Retail tenants in Hudson Yards, the sprawling development on the Far West Side of Manhattan, may be reeling, but companies are still moving in to the project’s office buildings.

“They still believe New York is the place to have their business and grow their business,” said William C. Rudin, chief executive of Rudin Management Company. “The Amazon commitment is amazing; the Facebook commitment is amazing.”

Some landlords see encouraging signs in their office buildings in the suburbs, where social distancing is easier because people tend to commute by cars. This, they argue, suggests that employers and workers want to return to the office and more of them will make their way back to New York, too.

Anthony E. Malkin, chief executive of the Empire State Realty Trust, which owns the Empire State Building, said the number of people coming into his office buildings in Connecticut in mid-August was 40 percent of what it was a year earlier, and up from next to nothing in the spring because of the strict lockdown policies in place at the time. “That is a very high number and it’s growing.”