Podcasts That Can Help You Manage Your Money

[ad_1]

There are hundreds (if not thousands) of financial podcasts out there offering a way to start your own business — such as, invest like a hedge fund manager or start flipping houses. But what if you don’t even know where to start when it comes to acquiring savings or balancing a budget? These podcasts are for people who know that they should be thinking more about their personal finances but aren’t even sure what the right questions are.

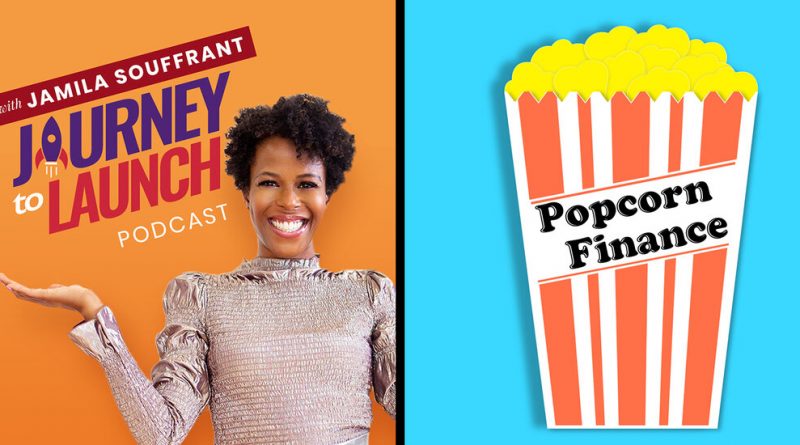

You may have heard of the FIRE movement (which stands for “financial independence, retire early”) and thought, “that sounds like a cult.” And while there are many podcasts by people in the movement, the certified financial education instructor Jamila Souffrant’s approach somehow appeals to all but feels as if it’s aimed directly at you. The Jamaican-born Souffrant was raised by a single mother who taught her the value of money at a young age. After experiencing a breakdown at a demanding job, Souffrant quit to spend time regaining control over her life, and in one year she and her husband had saved and invested over $85,000, using strategies geared toward financial independence. This is what she urges her listeners to seek: a life free of debt, allowing them to “launch” into a new life driven by their passions. Souffrant is an expert guide on the path to finding financial independence.

Nonmillennials, do not be discouraged by the title. This show is packed with understandable and empathetic financial advice that is useful for all generations. Shannah Compton Game, a certified financial planner and entrepreneur, noticed that her generation was woefully unprepared for the compounding financial catastrophes around them: multiple recessions, a student-loan crisis, stagnant wages and the rise of the nonbenefits gig economy. For the past six years, in over 200 episodes, Game has been on the hunt to find money tips that can change the way listeners of any age think, act and talk about money. With expert guests and creative angles, Game defangs the taboos around money and untangles confusion around any financial subject you might find yourself in, like talking about money with your partner, L.G.B.T.Q. financial planning, foolproofing your 401(k) or picking the right health insurance plan. Ultimately, “Millennial Money” makes a passionate case for finding your own individual path toward “money wellness” and the life you wish you could live.

By day, Chris Browning is a financial analyst. By night, he’s breaking down everyday money questions in roughly the time it takes to make a bag of popcorn (perhaps with an older microwave model). In 200 roughly 10-minute episodes stretching back to 2017, Browning answers quandaries on topics such as credit scores, student-loan repayment strategies, ethical investing, asking for a raise, or even tiny-house living. His jargon-free, calm and comforting delivery simultaneously gives the sense that any issue you have can be tackled and that everything is going to be OK. And if you want to hear him explain why you’re going to be OK, listen to his other podcast, “This Is Awkward,” with the subtitle, “But money doesn’t have to be,” in which listeners call in with cringeworthy money stories, and Browning and his co-host, Allison Baggerly, help them navigate the most embarrassing of situations without burning bridges.