Stock Markets Climb, Shaking Off a Grim Jobs Report: Live Updates

[ad_1]

The already sputtering economic rebound went into reverse in December, as employers laid off workers amid rising coronavirus cases and waning government aid.

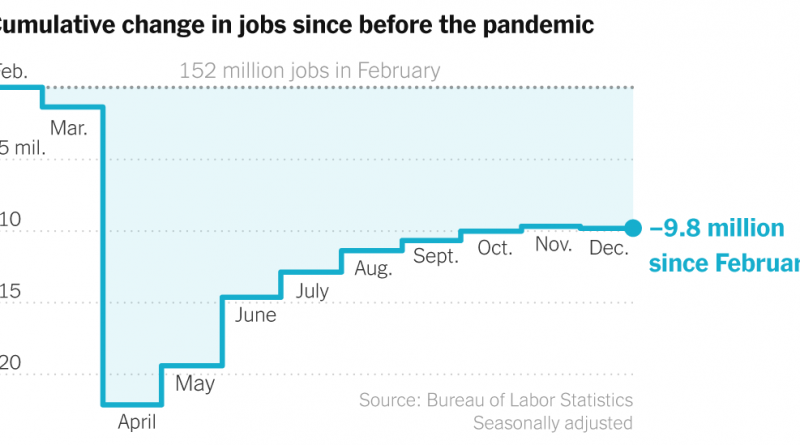

U.S. employers cut 140,000 jobs in December, the Labor Department said Friday. It was the first net decline in payrolls since last spring’s mass layoffs, and though the December loss was nowhere near that scale, it represented a discouraging reversal for the once-promising recovery. The U.S. economy still has about 10 million fewer jobs than before the pandemic began.

The December losses were heavily concentrated in leisure and hospitality businesses, which have been hit especially hard by the pandemic. The industry cut nearly half a million jobs in December, while sectors less exposed to the pandemic continued to add workers.

The unemployment rate was unchanged at 6.7 percent, down sharply from its high of nearly 15 percent in April but still close to double the 3.5 percent rate in the same month a year earlier.

“We’re losing ground again,” said Diane Swonk, chief economist at the accounting firm Grant Thornton. “Most notably, this is still very much a low-wage recession, and the losses were where we first saw them when the pandemic hit.”

Unemployment rate

By Ella Koeze·Seasonally adjusted·Source: Bureau of Labor Statistics

Hiring has slowed every month since June, and the economy lost more than nine million jobs in 2020 as a whole, the first calendar-year decline since 2010 and the worst on a percentage basis since the aftermath of World War II.

Congress last month passed a $900 billion relief package that will provide temporary support to households and businesses and could give a boost to the broader economy. And in the longer run, the arrival of coronavirus vaccines should allow the return of activity that has been suppressed by the pandemic.

But the vaccine and the aid came too late to prevent a sharp slowdown in growth.

“We did have a pullback in the economy,” said Michelle Meyer, head of U.S. economics at Bank of America. “If stimulus was passed earlier, maybe that could have been avoided.”

When the economy shut down last spring, many workers thought they would be out of a job for a few weeks, maybe a couple of months.

Nine months later, many still aren’t back on the job.

The Labor Department’s monthly jobs report on Friday showed that nearly four million Americans had been out of work for more than six months, economists’ standard threshold for long-term unemployment. That was up by 27,000 from November, and roughly quadruple the number before the pandemic began.

Those figures almost certainly understate the scope of the problem. People who aren’t looking for work, whether because they don’t believe jobs are available or because they are caring for children or other family members, aren’t counted as unemployed.

The number of people who have been unemployed long-term is still rising

Share of unemployed who have been out of work 27 weeks or longer

By Ella Koeze·Seasonally adjusted·Source: Bureau of Labor Statistics

When the data was collected in mid-December, many of the long-term jobless faced a frightening deadline: Federal programs that extended unemployment benefits beyond their standard six-month limit were set to expire at the end of the year. The aid package later passed by Congress and signed by President Trump extended the programs, but by less than three months.

Long-term joblessness was a defining feature of the last recession a decade ago, when millions eventually gave up looking for work, in some cases permanently. If that pattern repeats, it could have long-term consequences, particularly for people with disabilities, criminal records or other characteristics that make it hard to find jobs even in the best of times.

“These are the kinds of workers who are really only recruited and called upon in a very tight labor market, and it may take us a long time to get back there,” said Julia Pollak, a labor economist with the hiring site ZipRecruiter. “That is the worry, that there are these groups of people who will drop out now and who will only really find good opportunities again after a sustained and lengthy expansion.”

State and local governments continued to cut payroll employment in December, a sign that a crucial sector was bleeding jobs nine months into the pandemic.

Those governments account for about 13 percent of employment in the United States, which makes their trajectory extremely important to the nation’s labor market outlook. Because most are required to balance their budgets, lower income or higher expenses can lead to big job cuts.

State and local employers shed 51,000 workers in December compared with the prior month. As of last month, they reported 1.4 million fewer jobs than in February, the month before the pandemic job losses started.

The big employment cuts come despite revenue losses that appear milder than many analysts had expected at the pandemic’s outset. Louise Sheiner at the Brookings Institution estimated in a recent post that states would miss $350 billion in revenue over three years. Meanwhile, by her estimation, they received about $280 billion in direct and indirect federal aid in a March relief package, and about $120 billion more — largely indirectly — with the most recent fiscal package.

But expenses have shot up as the states try to deal with the public health crisis, which could leave budgets under strain even as federal aid helps to overcome revenue shortfalls. And the economic hit from the virus has not been evenly spread — some places are struggling more acutely.

From an employment standpoint, it’s also important that states were finalizing budgets when worse outcomes were expected, and may have cut back as a result, Ms. Sheiner wrote.

“What we’re seeing is that it’s different state to state,” Jerome H. Powell, the Fed chair, said at a news conference in December. But he pointed out that many employees had been cut from state payrolls, at least temporarily. “We’re watching carefully to understand why that many people have been let go and what really are the sources,” he said.

Wall Street continued its rally on Friday, fueled by bets on robust fiscal stimulus coming from a Democratic-led government in Washington, despite fresh evidence that the United States economy is backsliding as the pandemic surges.

The S&P 500 rose less than half a percent in early trading, after reaching a record on Thursday. The Stoxx Europe 600 was 0.6 percent higher, and the FTSE 100 in Britain dipped slightly. In Asia, the Nikkei 225 in Japan closed with a gain of 2.4 percent, climbing to a level it last hit in 1990.

Though Washington continues to reverberate after a pro-Trump mob overran the Capitol building on Wednesday, the investing world is instead focused on the wave of spending that could come as Democrats assume leadership of the White House and both houses of Congress.

Investors also seemed to look past the Labor Department’s report on December payrolls, which showed U.S. employers cut 140,000 jobs last month, the first drop since last spring. The weak report bolsters the argument that more economic stimulus is needed.

Analysts at Goldman Sachs said they expected $750 billion in additional spending in the first three months of the year, while their counterparts at Morgan Stanley are forecasting as much as $1 trillion in spending.

At the same time, few on Wall Street seem to think Democrats will prioritize tax increases, which had previously been seen as a potential risk of a Democratic sweep. The result is almost an ideal scenario for a range of investments geared to the short-term outlook for economic growth.

That’s been most evident in the so-called cyclical areas of the stock market, which include industrial, material and financial shares. Small-capitalization stocks, closely tied to the outlook for shorter-term American economic growth, are also rallying, as are companies that will profit from President-elect Joseph R. Biden Jr.’s pledges to spend heavily on infrastructure and alternative energy.

“Now you have the potential for more stimulus, even possibly an infrastructure spend,” said Kristina Hooper, chief global market strategist at the investment management firm Invesco on Thursday. “So, I think the stock market is enthused right now. And that enthusiasm is pretty strong.”

Gains continued in other financial markets too. Oil prices continued their rally, with Brent crude climbing 1.6 percent, to $55.25 a barrel, and West Texas Intermediate rallying to above $51 a barrel.

The yield on the benchmark 10-year Treasury note also continued to rise, reaching 1.09 percent on Thursday. The rise in yields most likely reflects expectations that the Treasury will be issuing large amounts of debt to finance renewed government spending.

Several states say they are moving quickly to restore federal unemployment benefits that lapsed last month when President Trump delayed signing a second round of federal pandemic relief.

A handful, including New York, Texas, Maryland and California, say they have started sending out the weekly $300 supplement that was part of the legislation, while others like Ohio say they are awaiting more guidance from the U.S. Labor Department.

Michele Evermore, a senior policy analyst at the National Employment Law Project, said that “at least half of the states should have something up by next week.”

Congress approved 11 weeks of additional benefits, and the entire amount will ultimately be delivered to eligible workers even if payments are initially delayed.

“Any claims for the first week will be backdated,” said James Bernsen, deputy director of communications at the Texas Workforce Commission.

In addition to a $300-a-week supplement for those receiving unemployment benefits, the $900 billion emergency relief package renews two other jobless programs created last March as part of the CARES Act.

One, Pandemic Unemployment Assistance, covers freelancers, part-time hires, seasonal workers and others who do not normally qualify for state unemployment benefits. A second, Pandemic Emergency Unemployment Compensation, extends benefits for workers who have exhausted their state allotment.

This latest round also offers additional assistance for people who cobble together their income by combining a salaried job with freelance gigs. The new program, called Mixed Earner Unemployment Compensation, provides a $100 weekly payment to such workers in addition to their Pandemic Unemployment Assistance benefits.

-

Boeing agreed to pay more than $2.5 billion in a legal settlement with the Justice Department stemming from the 737 Max debacle, the government said on Thursday. The agreement resolves a criminal charge that Boeing conspired to defraud the Federal Aviation Administration, which regulates the company and evaluates its planes. With less than two weeks left in the Trump administration, the agreement takes the question of how a Biden Justice Department would view a settlement off the table. President Trump had repeatedly discussed the importance of Boeing to the economy, even going so far last year to say he favored a bailout for the company.

-

Elon Musk, the chief executive of Tesla and SpaceX, is now the richest person in the world. An increase in Tesla’s share price on Thursday pushed Mr. Musk past Jeff Bezos, the founder of Amazon, on the Bloomberg Billionaires Index, a ranking of the world’s 500 wealthiest people. Mr. Musk’s net worth was $195 billion by the end of trading on Thursday, $10 billion more than that of Mr. Bezos’s. Mr. Musk’s wealth has increased by more than $150 billion over the past 12 months, thanks to a rally in Tesla’s share price, which surged 743 percent in 2020. The carmaker’s shares rose nearly 8 percent on Thursday.

-

Wayfair, the furniture and home goods e-commerce business, said on Thursday that all of its U.S. employees would be paid at least $15 an hour. The increase, which took effect on Sunday, applies to full-time, part-time and seasonal employees. More than 40 percent of Wayfair’s hourly workers across its U.S. supply chain and customer service operations received a pay bump.

-

The Tiffany-LVMH saga has finally come to a well-polished, multifaceted end. LVMH, the French conglomerate, completed its acquisition of the American jewelry brand on Thursday, and it was out with the old and in with the new — executives, anyway. After a brief transition period, gone will be Reed Krakoff, Tiffany’s chief artistic officer. Also leaving will be Daniella Vitale, the chief brand officer. In their place comes Alexandre Arnault, who will become executive vice president, product and communications.

The girl with the golden arm will live on.

Roku, the streaming platform, said on Friday that it had agreed to buy the rights to a content library originally created for Quibi, the much-hyped short-form start-up that closed just six months after its introduction.

The deal gives Roku, which makes streaming devices but also has a popular free streaming channel, a slew of original shows and films featuring well-known Hollywood stars such as Kevin Hart, Liam Hemsworth, Anna Kendrick and Idris Elba.

Quibi’s content library has about 75 shows and documentaries, which will appear for free on the Roku Channel throughout 2021. The deal gives Roku the rights to stream the content only for seven years, after which ownership reverts back to the producers of each show.

Roku did not disclose the price of the transaction.

Roku generates most of its money from advertising — it gets a cut of ad dollars from the ad-supported streaming channels on its device and it also owns the Roku Channel. But free ad-based streaming services is a tough business. Roku is still not profitable on an annual basis and analysts expect it won’t be in the black till 2022.

Started by Jeffrey Katzenberg and Meg Whitman, Quibi raised more than $1.75 billion from major Hollywood studios and other investors. The service was a quixotic attempt to capitalize on the streaming boom. Its shows, chopped into installments no longer than 10 minutes, were meant to be watched on smartphones.

But the pandemic dampened the appeal for that kind of viewing as people stayed home. Its unusual format and some of its creative choices, including a show starring the Emmy-winning actress Rachel Brosnahan as a character obsessed with her own golden arm, drew some ridicule.

Rob Holmes, the head of programming at Roku, said this “isn’t the start of a big push into original production,” but the addition of original shows gives the company more options. But later on down the line, it’s possible the company could fund more productions. “We’ll see,” he said.