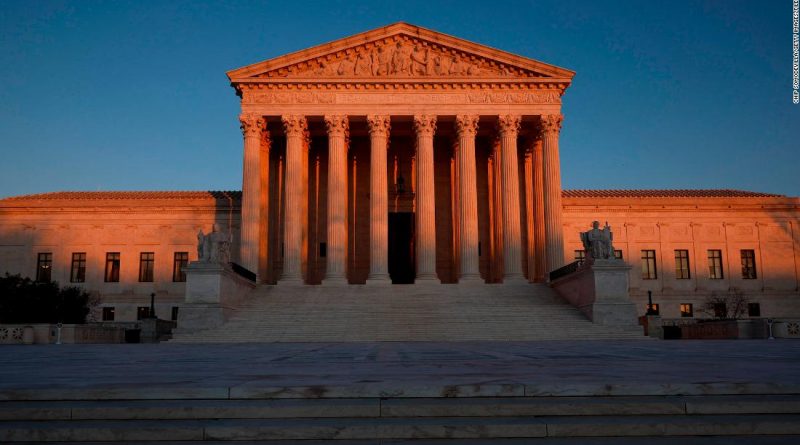

Student loan forgiveness Supreme Court arguments

[ad_1]

About 26 million people had already applied for President Joe Biden’s federal student loan forgiveness program when a federal district court judge struck down the plan in early November. No debt has been canceled thus far.

The Supreme Court will hear arguments on Tuesday in two cases related to the program, with a decision expected by late June or early July.

Here’s what to know about Biden’s challenged plan:

Who is eligible? If the courts ultimately allow the program to move forward, not every student loan borrower is eligible for the debt relief. First, only federally held student loans qualify. Private student loans are excluded.

Second, high-income borrowers are generally excluded from receiving debt forgiveness. Individual borrowers who make less than $125,000 a year and married couples or heads of households who make less than $250,000 annually could see up to $10,000 of their federal student loan debt forgiven.

If a qualifying borrower also received a federal Pell grant while enrolled in college, the individual is eligible for up to $20,000 of debt forgiveness.

What about current students? Some current students would be eligible under Biden’s plan if it’s allowed to take effect. Eligibility for borrowers who filed the Free Application for Federal Student Aid, known as the FAFSA, as an independent will be based on the individual’s own household income.

What kinds of loans qualify? There are a variety of federal student loans and not all are eligible for relief if the program is allowed to proceed. Federal Direct Loans, including subsidized loans, unsubsidized loans, parent PLUS loans and graduate PLUS loans, are eligible.

But federal student loans that are guaranteed by the government but held by private lenders are not eligible unless the borrower applied to consolidate those loans into a Direct Loan by September 29, 2022.

Will borrowers have to pay taxes on forgiven loans? Borrowers will not have to pay federal income tax on the student loan debt forgiven, thanks to a provision in the American Rescue Plan Act that Congress passed in 2021.

But it’s possible that some borrowers may have to pay state income tax on the amount of debt forgiven. There are a handful of states that may tax discharged debt if state legislative or administrative changes are not made beforehand, according to the Tax Policy Center. The tax liability could be hundreds of dollars, depending on the state.

Find answers to other questions about the program here.