U.S. Economy Grew 1 Percent in the Last Quarter of 2020

[ad_1]

The U.S. economic rebound faltered at the end of 2020 as surging coronavirus cases kept people home and a delay in federal assistance hampered many households and businesses.

But new injections of government aid into the economy and of vaccines into people’s arms should power a much stronger recovery in 2021.

U.S. gross domestic product rose 1 percent in the final three months of 2020, the Commerce Department said Thursday. That represented a sharp slowdown from the previous quarter, when business reopenings led to a record expansion of 7.5 percent.

The report capped what was, at least by one measure, the worst decline on record for a calendar year. And it underscored the challenge facing President Biden as he tries to revive the economy while quelling the pandemic. Democrats seized on the data as evidence that Congress should move quickly to approve more economic aid.

“The message is clear,” Brian Deese, a top economic adviser to Mr. Biden, said in a statement. “Without swift action, we risk a continued economic crisis that will make it harder for Americans to return to work and get on back their feet. The cost of inaction is too high.”

On an annualized basis, G.D.P. increased at a 4 percent rate in the fourth quarter, down from 33.4 percent in the third.

The late-year slowdown reflected a sharp pullback in consumer activity in the face of the resurgent pandemic. Governors and mayors across the country last fall reimposed restrictions on restaurants, bars and other in-person businesses, and public health officials discouraged holiday travel. Many analysts believe economic output declined outright in November and December, although the government doesn’t track G.D.P. on a monthly basis.

In addition, the trillions of dollars in federal aid that helped power the third quarter’s record-setting rebound faded late in the year. Personal income fell in the fourth quarter, as the loss of government assistance more than offset an increase in wages and salaries.

The slump “wasn’t just Covid — it was the lack of fiscal support,” said Aneta Markowska, chief financial economist at Jefferies, an investment bank.

But four weeks into January, the new year looks different. Aid passed by Congress in December has begun to flow in enhanced unemployment benefits, small-business loans and direct payments to households. Two runoff elections in Georgia delivered Democratic control of the Senate, making further rounds of assistance more likely. And the rollout of coronavirus vaccines, though slower than hoped, offers the prospect that hotels, bars and other businesses hurt by the pandemic will see customers return later this year.

“That fiscal stimulus is helping push the train of the economy through the tunnel, and the light on the other side is widespread vaccination and inoculation,” said Nela Richardson, chief economist at the payroll processing firm ADP.

Mulvaney’s Building & Loan, a farm-to-table restaurant in Sacramento, survived the first months of the pandemic with the help of a loan from the federal Paycheck Protection Program and reopened for outdoor dining in June. But shortly after Thanksgiving, Gov. Gavin Newsom ordered California restaurants to shut back down as coronavirus cases soared.

“That kind of took the wind out of our sails for the first time,” said Patrick Mulvaney, the restaurant’s chef and co-owner. “It’s that process of closing and opening and closing and opening that really gets you.”

The shutdown meant that the restaurant missed out on the holiday season, which ordinarily accounts for a quarter of its annual business, and forced Mr. Mulvaney to lay off workers he had rehired over the summer.

This month, however, Mr. Newsom lifted the order, and last weekend, Mulvaney’s outdoor tables were bustling in 70-degree weather.

“I said to someone last week, ‘I think I feel a glimmer of hope,’” Mr. Mulvaney said.

Adding to the optimism, the damage from the year-end slowdown does not appear to have spread to the broader economy. Sectors less exposed to the pandemic, such as construction and manufacturing, have continued to grow.

“It’s worth emphasizing how much other sectors of the economy really kicked in to offset the softening in consumption,” said Robert Rosener, senior U.S. economist at Morgan Stanley.

Still, the economic turnaround won’t happen overnight. Data from the Labor Department on Thursday showed that 874,000 people applied for state unemployment benefits last week, and a further 427,000 filed for Pandemic Unemployment Assistance, an emergency federal program for people who don’t qualify for regular benefits. Both totals were down from a week earlier but are still higher than before the latest wave of the pandemic hit last fall.

Most forecasters expect economic data to show that the economy remained weak in January, and while they predict an upturn in February, that is contingent on a continuing decline in virus cases that allows more activity to resume. A more complete rebound depends on widespread vaccination, which is expected to take months.

“Everything goes back to the health crisis,” said Rubeela Farooqi, chief U.S. economist at High Frequency Economics. “Once you get most of the population vaccinated, that’s a completely different picture.”

The G.D.P. report on Thursday showed the damage done by the pandemic, but also the role federal aid played in offsetting that damage. Personal income and saving both rose in 2020 compared with 2019, despite the loss of millions of jobs. The aid allowed families that might otherwise have been devastated to pay rent and buy food — and, in doing so, prevented a much larger drop in spending. The Federal Reserve cut interest rates almost to zero, fueling sales of homes and automobiles.

“The fiscal stimulus package was not perfect,” said Stephanie Aaronson, an economist at the Brookings Institution. “But the truth is both Congress and the Fed acted very, very quickly, and I think that did save the economy from a much worse outcome.”

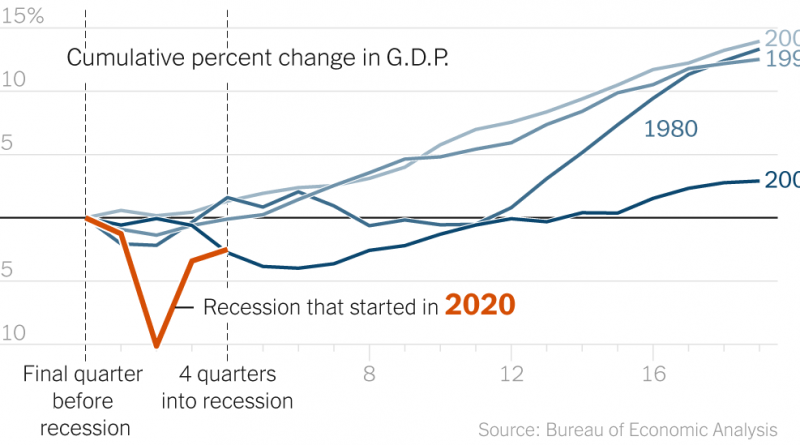

Measured against the final quarter of 2019, G.D.P. ended 2020 down 2.5 percent, making it the second-worst calendar year on record after a 2.8 percent contraction in 2008. Comparing 2020’s output over all with the previous year’s, G.D.P. fell 3.5 percent, the worst since reliable records began after World War II. The economy has regained roughly three-quarters of the output lost during the collapse last spring, and a bit more than half of the jobs.

But by any measure, the economy has rebounded more quickly than nearly any forecaster initially expected. In May, economists at the Congressional Budget Office estimated that G.D.P. would end the year down 5.6 percent and wouldn’t reach its pre-pandemic level until well into 2022. Now, most forecasters expect it to hit that benchmark this year.

Last year’s overall showing was “bad but not historically bad, and not as bad as what was experienced in the Great Recession, and not nearly as bad as what was expected midyear,” said Jason Furman, a Harvard economist who ran the Council of Economic Advisers under President Barack Obama.

Both the recession and the recovery have been highly unequal. Many white-collar workers have kept their jobs, have been able to work from home, and have built up savings by cutting back on vacations and restaurant meals. Wealthier families have also benefited from rising home values and a soaring stock market.

Low-wage service workers — disproportionately Black or Hispanic — have borne the brunt of both the job losses and the virus itself, because many of them had to risk exposure at work. Unemployment benefits and other government programs have helped dampen the impact, but only for those able to receive them. School closings have pushed millions of parents, particularly mothers, out of the work force, and many may struggle to return to work.

“It’s the tale of two economies,” said Constance L. Hunter, chief economist at the accounting firm KPMG. Workers who have been relatively unscathed by the recession are eager to resume spending as soon as the public health situation allows. But for the worst-hit groups, she said, “there is significant economic scarring potential.”

Patricia Cohen and Jim Tankersley contributed reporting.